Even if you are not a scam victim yourself, chances are you know of someone who has fallen prey to these devious schemes. Scam cases are so rampant these days that you can’t browse social media or read the news without seeing such reports daily. For all the good that it has given us, our digital way of life has also enabled scammers to devise cunning tactics to trick unsuspecting victims into parting with their money or personal information. Thus, knowledge of the ins and outs of scam tactics is the best defensive weapon you can arm yourself with to combat them. This article will explore the different types of common online scams in Malaysia and the measures that can be taken to avoid becoming a victim yourself.

What Is The Statistic Of Online Scams In Malaysia?

According to police statistics, there were as many as 98,607 online scam cases reported in Malaysia between 2017 and 2021 that involved losses totalling a whopping RM3.3 billion. Meanwhile, a total of 4,340 cases with losses amounting to RM665 million were recorded in 2022.

What Are The Most Common Online Scams In Malaysia?

Beware of these schemes.

1. Investment Scams

In investment scams, fraudsters will try to promote non-existent investment schemes via social media platforms that promise high returns with little to no risk. They may come disguised as different types of business opportunities for various products or services.

Some red flags to watch out for are investment opportunities that sound too good to be true, will guarantee profits, and are offered for a limited time only. They may also use fake testimonies, fake certificates, or pose as legitimate entities by using names, logos, credentials, and websites to promote the bogus investment schemes.

You may receive the promised returns in the first few months, but the money will eventually stop coming in with various excuses given.

How to avoid investment scams: Be aware of the telltale signs, and check the investor alert list on the Securities Commission Malaysia website that contains unauthorised websites, investment products, companies, and individuals before investing.

2. Job Scams

Scammers will typically advertise fake overseas job postings on social media platforms that offer attractive salaries, targeting the jobless and those desperate to earn higher wages. Those who take the bait would be required to fly to a neighbouring country. Once there, they will be taken to a heavily-guarded compound and forced against their will to work as cyber scammers. Victims are typically beaten and treated inhumanely if they fail to hit their daily targets.

What makes this scam a particularly dangerous one is that victims will find it very hard to escape their captors without the help of authorities.

How to avoid job scams: Avoid signing up for jobs advertised on social media and text messaging platforms. Always go through reputable job sites or recruitment agencies.

3. E-commerce Scams

No doubt, the proliferation of online shopping has led to a sharp rise in e-commerce scams. This type of online scam in Malaysia can take form in many different ways, but they are all crafted to get potential victims to make payments that do not lead to the delivery of goods or to provide personal information unknowingly.

E-commerce scams are fast evolving with new tricks constantly devised to fool even the most on-guard consumers. Hence, it is crucial to keep yourself informed and updated on all these tactics to avoid being part of the statistic yourself.

You can read all about the latest Shopee scams here and how to avoid them.

How to avoid e-commerce scams: Only perform your transactions on the official online shopping apps. If you receive text messages, SMS, or emails purportedly from e-commerce companies that you are unsure about, always verify them by contacting their customer service.

4. Money Muling

A mule account is a bank account used to receive and transfer funds acquired illegally on behalf of others. Scammers will contact potential victims and promise monetary rewards in exchange for using their bank account or ATM card to receive (illegal) money. Not only that, they will also be instructed to transfer the money into another mule account.

While it might appear harmless as the victims do not lose anything of value, mule account holders will face legal action if the fraud is detected.

How to avoid money muling scams: Do not allow your account to be used or handled by any third party or unknown persons.

5. Illegal Loans

It cannot be denied that many are facing hardships in the current economic climate and will resort to taking loans to ease their financial woes. Despite the existence of licensed moneylenders, many still prefer to seek out loans from advertisements they saw online (due to reasons such as fewer restrictions to obtain loans), or they may be contacted by a syndicate member posing as bank staff or agent.

Once they borrowed money from these illegal moneylenders, victims would be harassed relentlessly by scaremongering tactics to pay up, often much more than the amount they borrowed due to the exorbitant interest rates imposed.

How to avoid illegal loan scams: Only borrow from licensed moneylenders. You can cross-check the company’s registration number through the Ministry of Local Government Development’s eMAPS system or i-Kredikom mobile app (iOS, Android).

6. Love/Romance Scams

Victims get to know an attractive person through social media and strike up a romantic relationship with them after being swept off their feet by sweet words. Of course, these online sweethearts are nothing more than fake personas created to fool smitten victims into parting with their money.

Soon after gaining the victims’ trust, scammers will cook up various stories to get them to send money in aid. These range from having troubling family issues that elicit sympathies to having valuable packages addressed to the victims halted by immigration pending some fees to be settled.

These online love scams in Malaysia can also descend into blackmailing or sexploitation if the fraudsters manage to get hold of compromising/intimate photos or videos of the victims.

How to avoid love/romance scams: Avoid engaging with overly-friendly strangers online. Do an extensive background search on their profile and be on guard when they request for help in monetary form.

What Can I Do If I Got Scammed Online In Malaysia?

If you suspect you have fallen victim to an online financial scam in Malaysia, the first thing you should do is immediately contact your bank’s 24-hour hotline to report the incident so the bank can intercept your stolen fund. You should also change your banking account password at once.

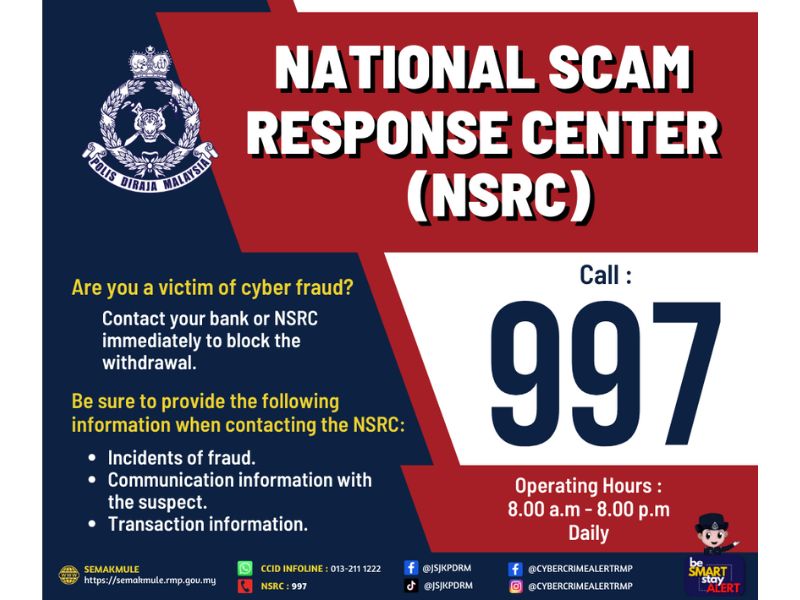

Alternatively, you can call the National Scam Response Centre (NSRC) at 997, which will also act to block the withdrawal of the victim’s money from the banking system.

After contacting either your bank or the NSRC, go to your nearest police station to lodge a report to enable the authorities to carry out a formal investigation.

General Tips On How To Avoid Online Scams In Malaysia

Save yourself from headaches and heartache by internalising these tips.

Dos:

- Always check that the financial/banking websites you visit (or you are led to) are legit and secure—characterised by the padlock icon to the left of the URL and that the URL begins with “https://”

- Cross-check any unknown phone numbers and banking accounts through the Semak Mule portal that is initiated by PDRM. Also available in Android app form.

- Call the bank directly to verify any transaction/banking activities you are unsure about.

- Always remind yourself to be suspicious of deals/offers that sound too good to be true.

Don’ts:

- DO NOT share your bank account details (internet banking user name and/or password, ATM card, PIN Number, or TAC) with a third party.

- DO NOT click on any links sent over by people or numbers that you are not familiar with.

- DO NOT download any mobile apps as instructed by a third party, especially those that require you to input your particulars and banking details.

- DO NOT wire money to strangers online that you have never met, no matter how convincing or desperate they sound.

- DO NOT put yourself in a compromising position when facing a webcam.

You Can Avoid Being A Victim Of Online Scams In Malaysia By Staying Informed And Vigilant At All Times

Despite the countless horror stories and warnings, people continue to get duped and lose an insane amount of money to online scams in Malaysia with no signs of slowing down. While it is impossible to wipe out all scammers, the very least you could do to safeguard yourself and your loved ones from falling victim is to equip yourselves with the necessary knowledge to minimise the chances of getting tricked easily. Lose the mentality of “it only happens to other people” and always question the things you see or hear online. Share this story with a friend or loved one to keep them informed of these unscrupulous acts!