Adulthood comes with the heavy responsibility of managing your own finances, and it is no fun. In a world where we are encouraged to spend like there is no tomorrow, it is a constant struggle to balance what is going out and what is coming into our wallets. Thankfully, help can come in the form of money management apps. From keeping track of your spendings to managing your financial matters all on one convenient platform, these apps should be on the smartphones of every single individual who wishes to be more financially responsible.

Best Money Management Apps To Download

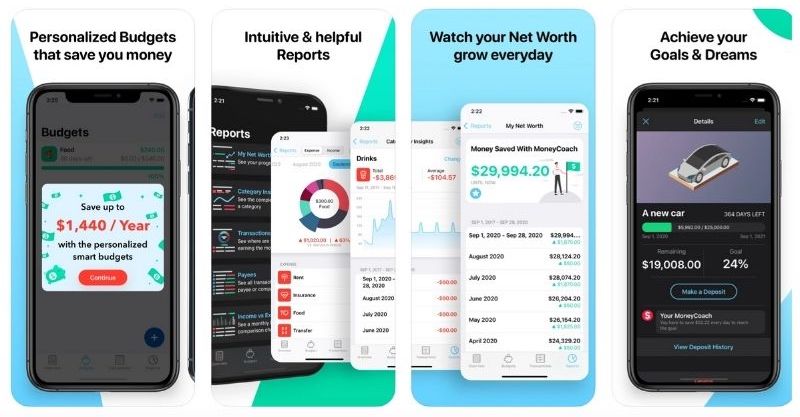

MoneyCoach

MoneyCoach helps you create healthy financial habits and develop your financial skills to reduce financial stress. You can create smart, personalised budgets to help you save money every month as well as set individual goals to work towards. The app also gives you complete control over all your accounts, which include offline bank accounts, savings accounts, and credit cards, among others. You can even check your net worth in real-time. MoneyCoach is available for almost all devices in both Apple or Android ecosystems.

Spendee

If you want to see all your money in one place, Spendee is the money management app for you. From online banking to E-wallet (e.g. Paypal), or even crypto-wallet, you can easily view where your money is at a glance. Connect the app to your bank accounts, and you can have all your transactions imported. Spendee makes things easy for you as the app automatically categorises your data and presents them in simple infographics, stylish graphs, and clever insights. If you have partners, family members, or roommates that you wish to manage financial expenses with, the app’s shared wallets feature lets you do just that.

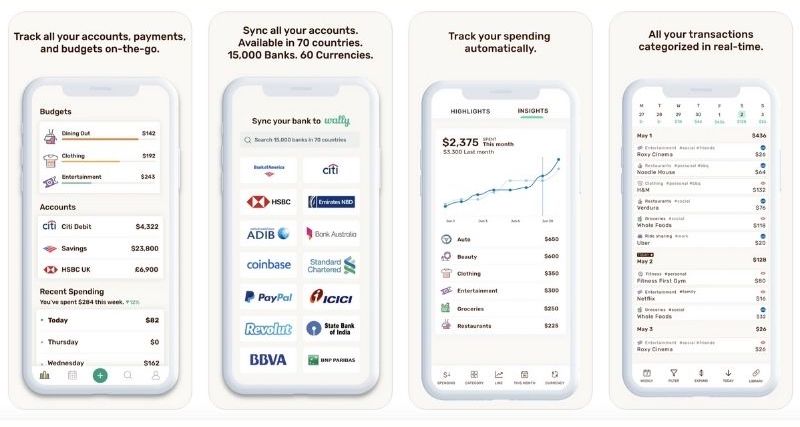

Wally

Wally is an app that is recommended by personal finance experts, bloggers, as well as leading publications that include Forbes, Economic Times, CNN, and Wall Street Journal, among others. It does everything from tracking your budget spendings to helping you keep your financial life organised with real-time updates. All your accounts are centralised for you to manage, learn, and improve your finances. On top of that, it boasts the widest global network covering 15,000 banks in 70 countries plus over 200 currencies. You also don’t have to worry about security issues as the app is end-to-end encrypted, PCI compliant, ISO 27001 certified, and GDPR compliant.

Download: iOS

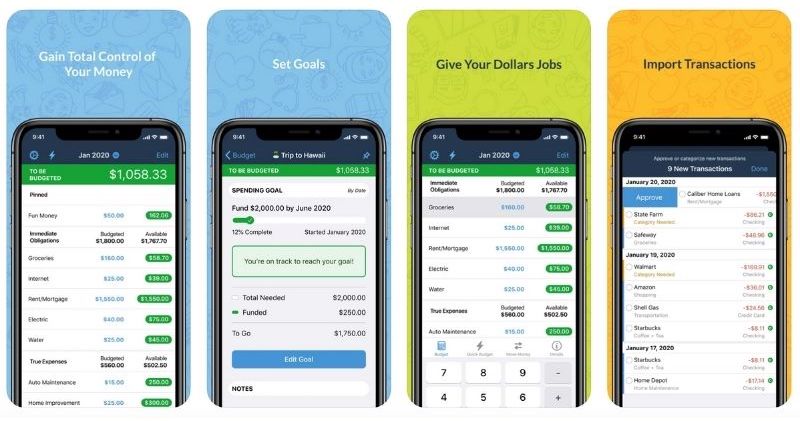

You Need A Budget (YNAB)

Other money management apps may provide you with all the tools you need to manage your finance, but it’s all up to you to make things work. YNAB comes with its own proven formula—the YNAB’s Four Rules—that has worked for many users looking to be in total control of their financial life. Among its key features are bank synching, goal tracking, and debt paydown, which has all the tools and teachings to get you out of debt for good. The app claims that on average, new users save $600 (approx. RM2,430) in the first two months and more than $6,000 (approx. RM24,300) in the first year. You can give it a try with the 30-day free trial before deciding whether you want to be subscribed annually.

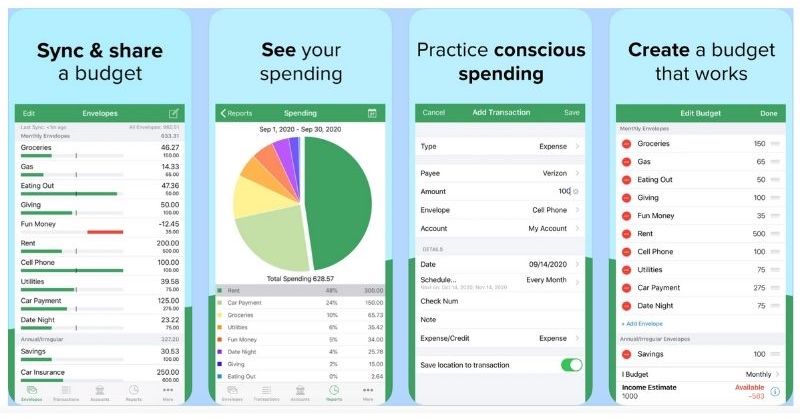

Goodbudget

Want an app that specifically lets you manage financial matters with your loved ones? Goodbudget fits the bill. You can share a budget with another individual, be it your spouse, family member, or a friend across multiple phones as well as the web. Goodbudget is based on the envelope budgeting method—a simple, systematic way of saving money and paying bills. It helps maintain a personal budget while setting aside what you need for settling bills.

Daily Budget Original

Daily Budget Original is the go-to pick if all you need is a simple and easy-to-use app without all the bloated bells and whistles. It does not connect to your bank accounts, so there is no need to worry about your sensitive data being misused or anything. You are required to key in just your regular income, recurring expenses, savings goal, and the app will automatically calculate how much you can spend every day. It’s the perfect app to get started before you venture into exploring other more complex money management apps.

Download: iOS

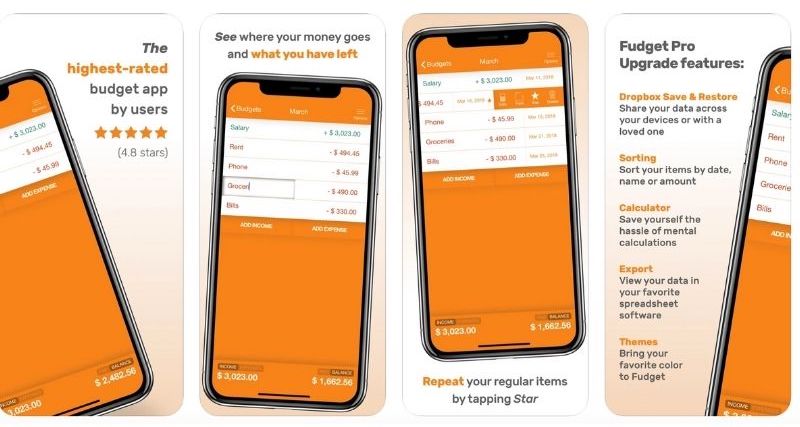

Fudget

Here is another great option if you are looking for simplicity above anything else. With Fudget, you can create simple lists of incoming and outgoing expenses to keep track of the balance. One-tap adding and editing makes the whole experience of using the app fast and fluid. There are also no time constraints so you can use it weekly, monthly, or however you like. The app has little to no learning curve so you can get started right away. To unlock its pro features, which include Dropbox integration, calculator, CSV export, and the removal of ads, you’ll have to make in-app purchases.

Make The Most Out Of These Money Management Apps To Improve Your Financial Health

Keeping track of all your expenses is no easy task. There are essentials to purchase, bills to pay, indulgences to fulfil, and emergencies to cover. If you’re not careful, all these spendings can quickly exhaust whatever you’re earning every month and leave you with zero savings. And that is not something you—or anyone else for that matter—would want. It is never too late to start managing your money, so why not start with a budgeting app? Whether it is a feature-packed or simple-yet-effective money management app that you’re looking for, these apps have all the tools you need to better manage your personal finances, which in turn will lead to a higher-quality life!

Want to explore more useful apps? Why not check out these best language-learning apps!

Check out Tech Thursday for 1-day only lowest price, unbeatable deals and extra 20% Coins Cashback every Thursday!